A unique strategy to deliver high impact and market returns

Our investment team actively manages the portfolio to give you positive returns integrated with positive change. You also get access to greater impact through private markets opportunities that aren’t readily available to individual investors.

Meet the CIO:

“The Snowball portfolio optimises the benefits of diversification. In comparable portfolios, for example, public equities would be more dominant, but we are much more balanced. We identify, and actively manage, investments where financial returns are aligned with positive impact. The net result is higher quality and more sustainable returns, which are less dependent on movements in the market. Looking ahead, we’re increasing our investments in private markets because we see the potential for higher impact and better returns from the capital invested.”

Our impact framework

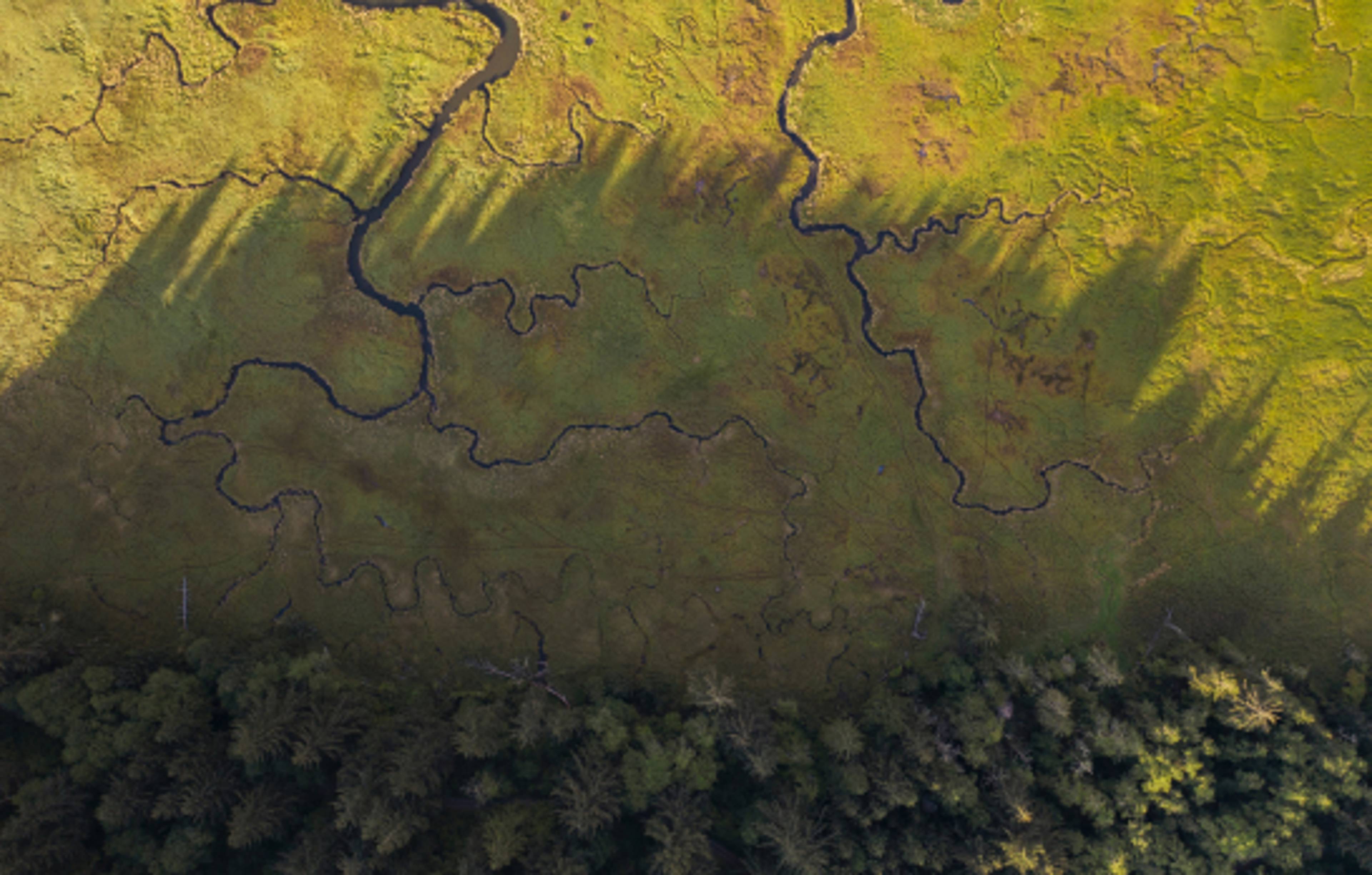

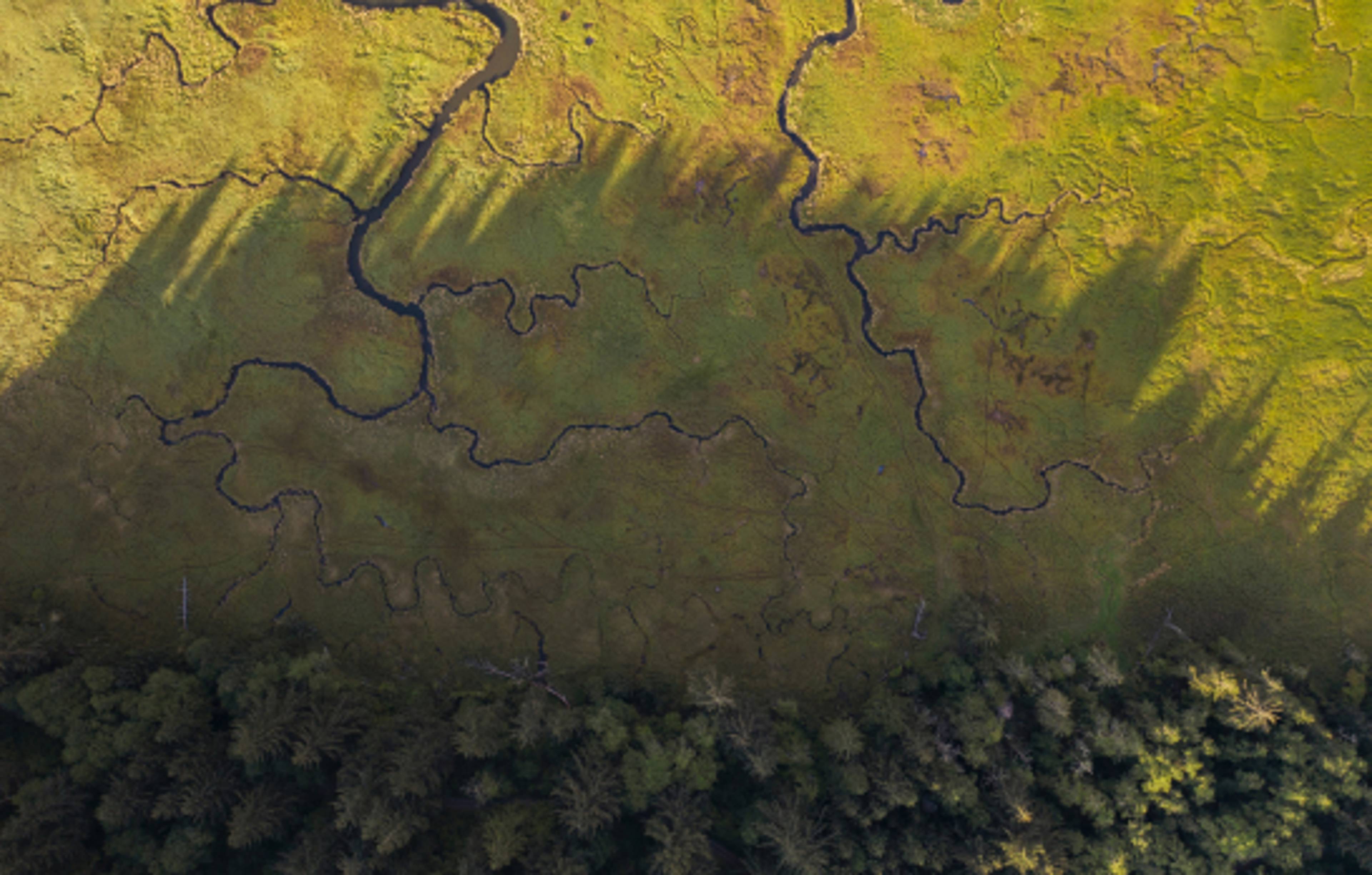

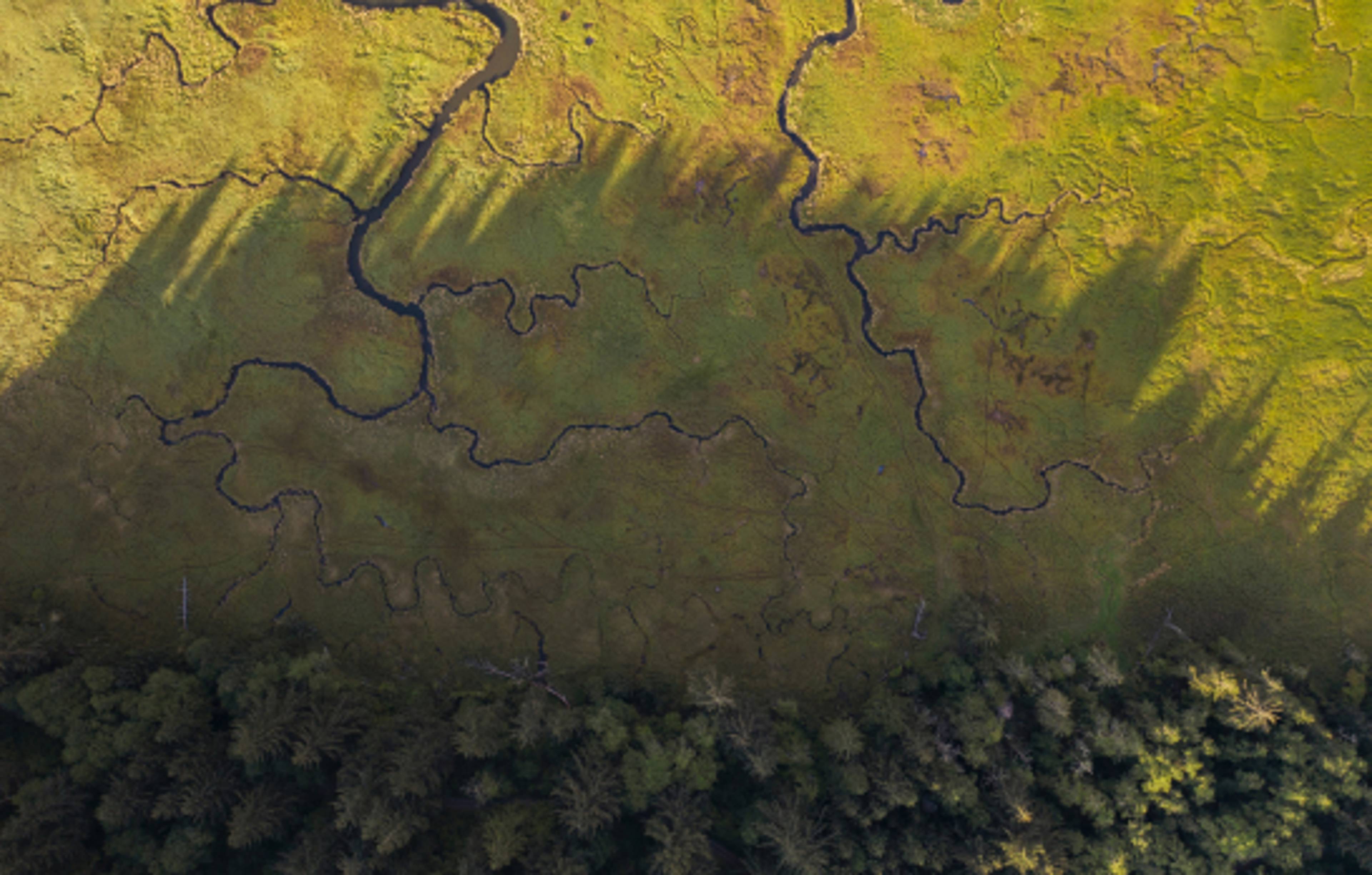

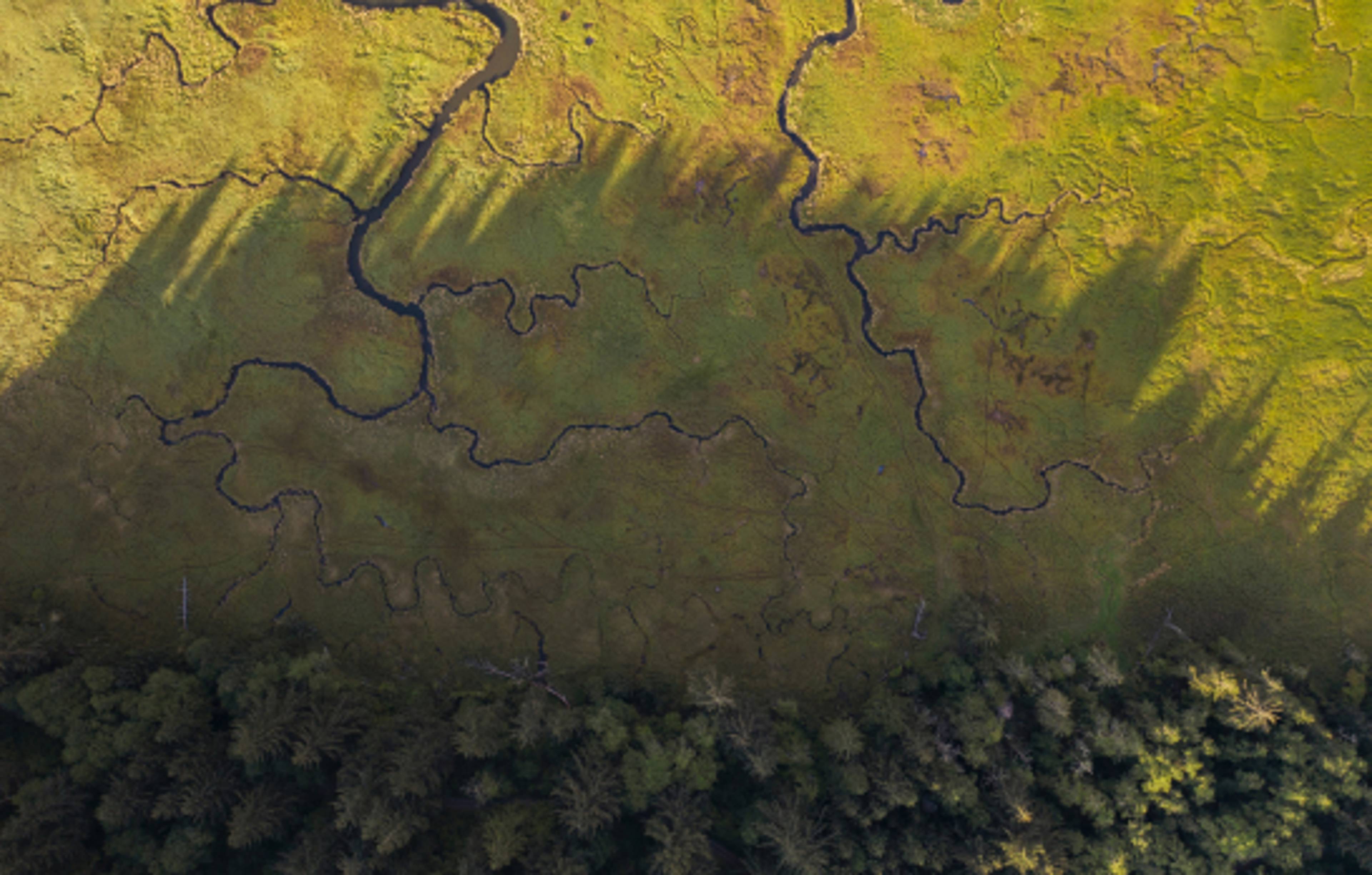

We invest across six themes that contribute to positive social and environmental impact. These are: Energy transition, Resource efficiency, Regenerative ecosystems, Homes and communities, Equity and Inclusion, Health and wellbeing. To help us assess each potential investment, we use a framework based on the Impact Management Project 'Five Dimensions of Impact'. This is a widely used approach for gauging the impact of investments on people and the planet.

Mission & behaviours

What drives the organisation and how determined is it to live those values?

Impact process

What is the impact thesis and how is it being measured?

Active ownership

How does the fund manager approach active ownership?

Catalytic

How is the fund manager acting as a pioneer to achieve impact?

Impact risk management

What are the key risks around investing for impact?

How we measure impact

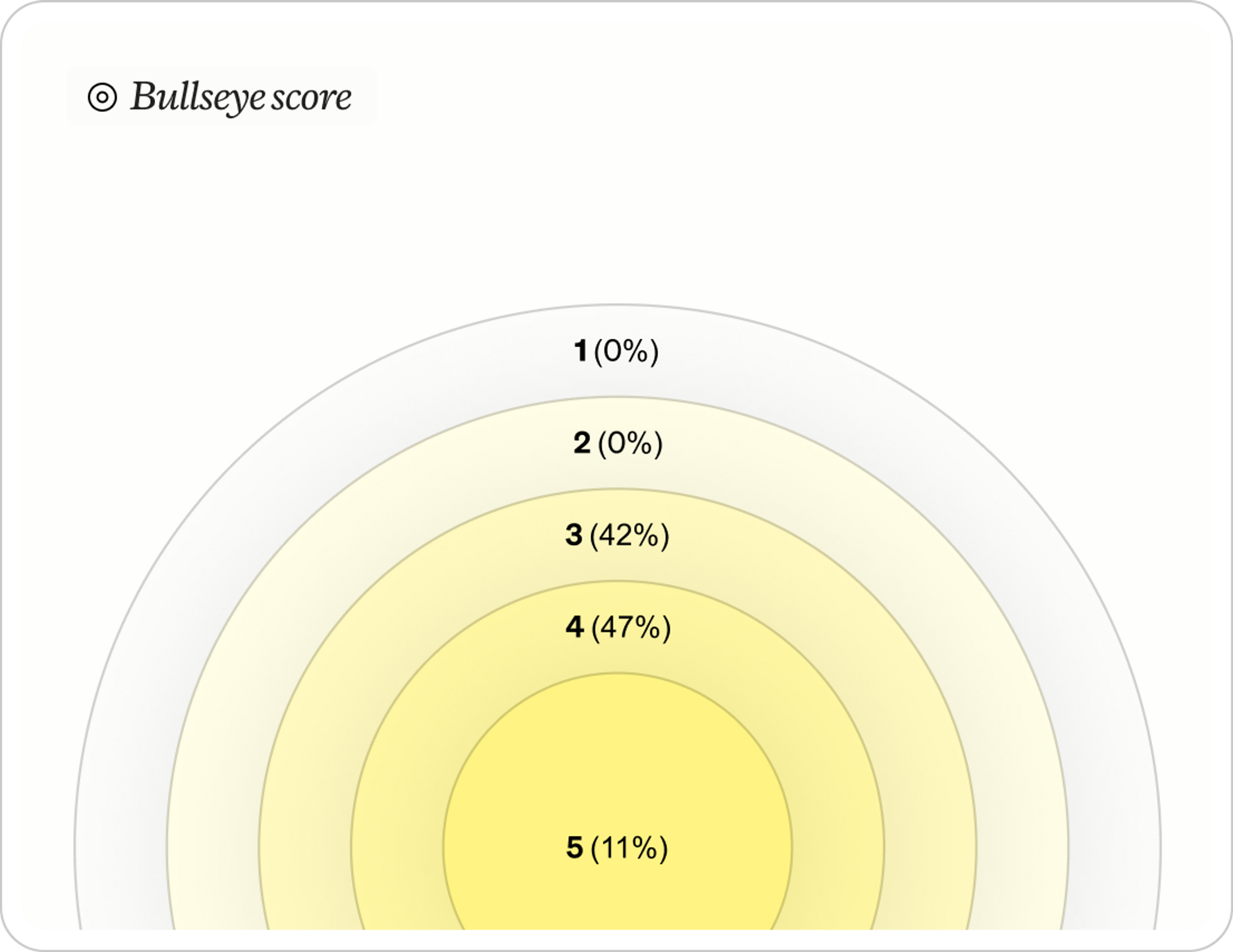

We use our own method to calculate the impact intensity of each investment we make. We call it the Snowball ‘bullseye score’, and we derive it from criteria which assess manager impact and enterprise impact.

The goal is simple: drive the score to the middle of the bullseye to maximise the impact of our portfolio.

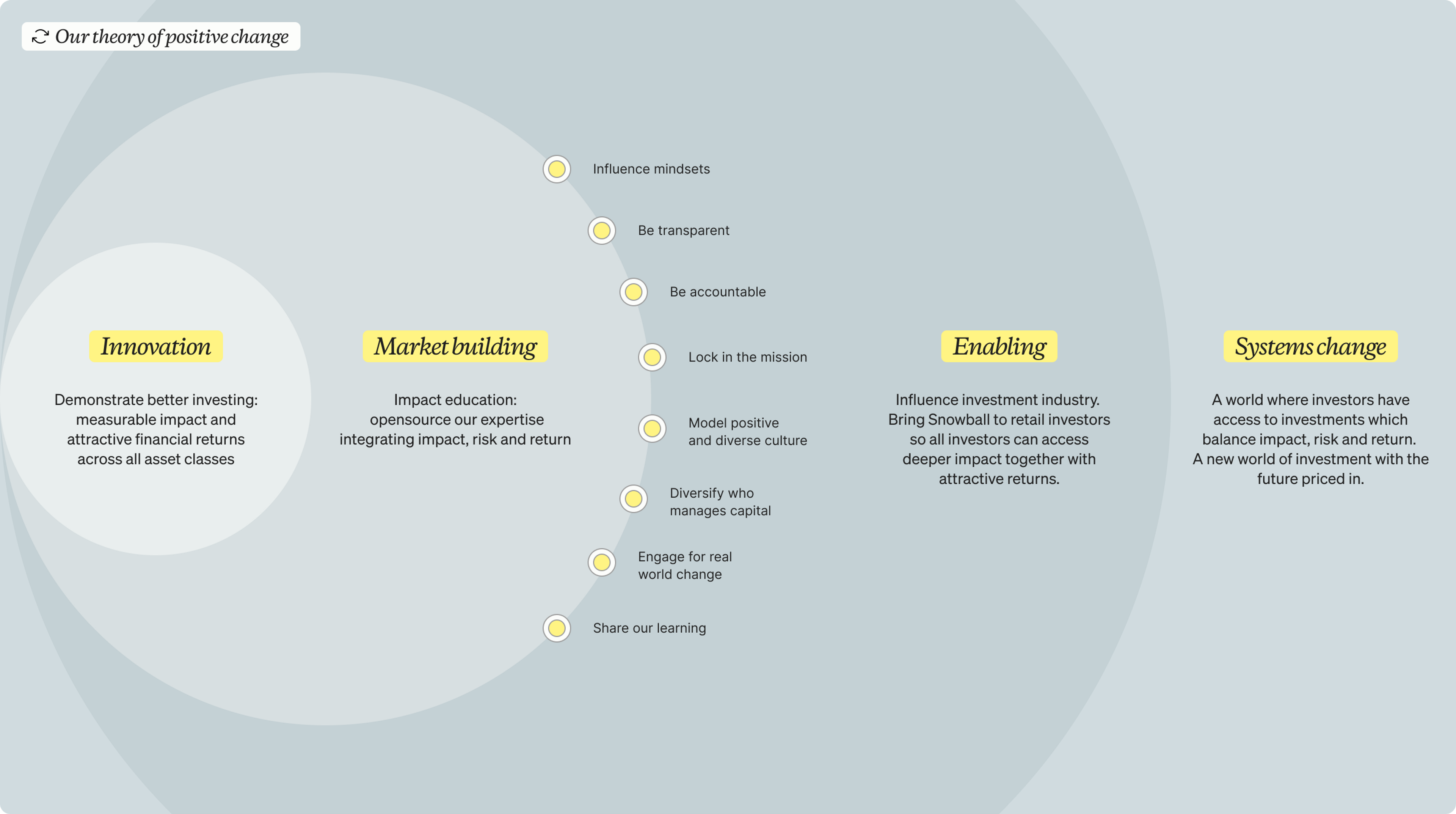

Our theory of positive change

We’re proving that there’s a better way to invest – one that delivers measurable impact and attractive financial returns. Looking ahead, our mission is to make this kind of investing open to all and to change the investment industry so that it thinks and acts for the better.

Explore our impact methodology

We’re open about our investment approach because transparency and shared learning help the wider adoption of better investing. That’s why we’ve published a series of three reports in which you can find out more about our experience managing investments for impact, risk and return.

Snowball impact report

Discover how we assess our own impact, and set standards by sharing the detailed findings from an independent verification of our impact processes.

2022

7.7MB

Manager impact report

Find out how we assess the impact our fund managers create.

2020

11.1MB

Enterprise impact report

Find out how we assess the impact of the companies and solutions in our portfolio.

2018

0.4MB