How we measure impact

Jake Levy, Senior Investment Manager, Snowball

Wed 1 September 2021

An overview of the Snowball impact framework

We have a diversified, multi-asset portfolio which we optimise for risk, return and impact. This isn’t easy. It is particularly challenging for us given the breadth of our portfolio, which ranges from housing for those at risk of homelessness to cleantech venture capital. In fact, it’s incredibly hard to compare these in a meaningful way.

We have developed our own impact assessment framework which has been informed by evolving best practice across the sector, including the Impact Management Project, Impact Frontiers and the Operating Principles for Impact Management.

The framework has three levels.

Snowball impact: how Snowball allocates capital to solutions which create a positive change and engages with its investees to maximise their impact.

Manager impact: whether Snowball’s managers are mission-driven, with a robust impact practice and work with their investees to improve their impact.

Enterprise impact: the potential and actual impact on people and planet of the investments that managers hold on behalf of Snowball.

A set of 50 questions is used to score the manager impact and enterprise impact of each investment – both during due diligence and on an annual basis post-investment to monitor impact performance.

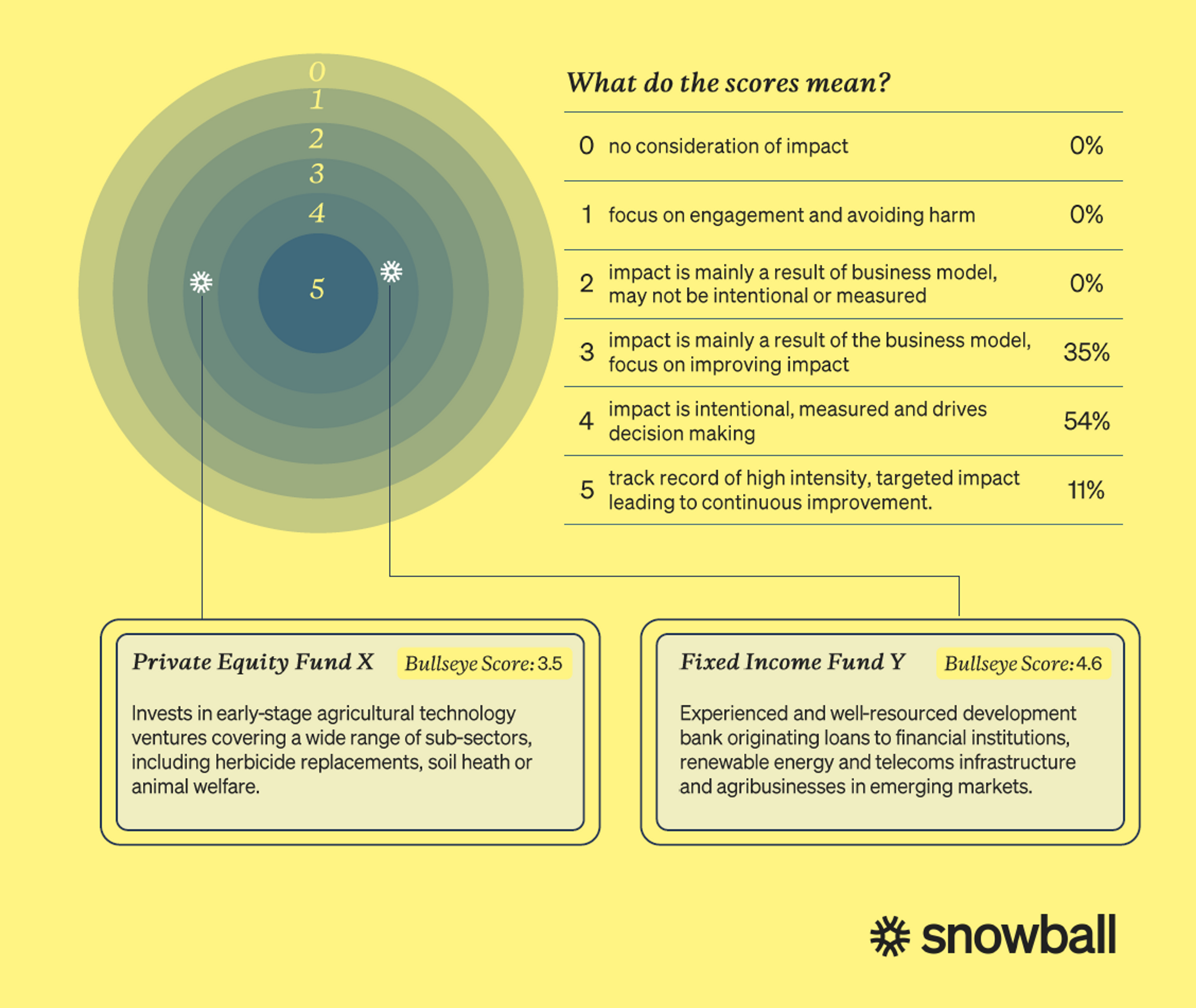

The combination of the manager impact score and the enterprise impact score creates the bullseye score, which quantifies the impact intensity of the Snowball portfolio.

Our bullseye framework has two levels: firstly, the manager impact and secondly, enterprise impact.

Manager impact

Starting with the manager impact, we assess each fund manager against five categories. This builds on best practice such as Impact Management Project’s investor contribution strategies.

Mission and behaviours

Is the manager mission-driven, open and committed to learning and improvement – with impact at its core? We want to know if the managers assets are all invested for impact and if it lives its values – for example, is the manager a B Corps with protection in place against mission drift?

An example of a manager which scores well in this area is Ananda Impact Ventures. We recently invested in their fourth impact venture fund. We believe that Ananda walks the walk when it comes to impact, for example, their carry is tied to impact, they have an impact term sheet for each investee which includes the company’s mission statement, and an independent advisory committee which signs off on KPIs and targets.

Impact process

We want to know the manager’s impact thesis and whether it has a robust process to assess and measure impact. Crucially, we also look at whether the impact data is actually used to improve outcomes, something which is often overlooked. Otherwise, what is the point in collecting the data?

Active ownership

We look at how a manager engages with its investees. This differs depending on the asset class. For our venture capital managers, we expect them to support their investees to scale, often by taking board seats, making useful introductions and helping to build out the team. This should also involve developing the company’s ESG and impact practice, so it is embedded in the company’s DNA as it grows and continues following exit.

For public equity managers, we are interested in how they engage with their investees and escalate issues, including voting against management or even ultimately selling a position.

Catalytic

To assess whether an investment is catalytic, we look at whether the investment is growing new markets, field building or unlocking wider systems change.

Our investment into Resonance’s Women in Safe Homes fund is an example of a catalytic investment catalytic. The fund provides residential and refuge accommodation to vulnerable women, such as those experiencing homelessness, survivors of domestic abuse or prison leavers and is believed to the world’s first gender-lens property fund. It is particularly innovative as the manager is employing a new lease structure that is a half-way house between the needs of the charity partner and the investor to share risk in a fair way.

Impact risk management

This assesses the manager against a number of criteria such as whether we believe it can execute on its impact thesis and whether its strategy is an efficient use of capital to achieve the desired impact.

Enterprise impact

This image shows the enterprise impact layer of Snowball's impact framework. This consists of five dimensions what, who, how much, contribution and risk.

Enterprise impact is more straightforward, assessing an investment against the Impact Management Project’s five dimensions of impact. The five dimensions look at:

“what” outcomes the enterprise is contributing to;

“who” the stakeholders are and how are underserved they are;

“how much” impact through the breadth, depth and duration of the outcomes;

“contribution” looks at the impact against the status quo; and

“risk” tells us the likelihood that impact will be different than expected.

We score each underlying investment a manager makes against the five dimensions. For example, we have scored the enterprise impact of each of the 29 impact bonds in Rathbones’ portfolio. This gives us a real sense of whether a manager is delivering what it set out to do, and we may challenge the team if we think some investments are not in line with their impact thesis.

The manager impact score and enterprise scores are then combined to give a bullseye score out of five, which represents the impact intensity of an investment.

A guide to the Snowball bullseye – what do the scores mean?

We use our in-house methodology to calculate the impact intensity of each investment in the portfolio, we call this the bullseye score. The score for each fund is then weighted by the size of that investment to come up with the bullseye score for the portfolio as a whole. We score our investments on a scale of 1 to 5, with 1 being old fashioned ethical fund that uses negative screening to avoid harm, and 5 being a fund with a track record of high intensity impact leading to improved outcomes.

Within Snowball’s portfolio, 11% of the portfolio scores 5 (these funds are Bridges Social Impact Bond Fund, Bridges Social Outcomes Fund II, FMO, Lendable, Real Letting Property Fund I, National Homelessness Property Fund I.

At Snowball, we believe high intensity and lasting impact is very hard to achieve, and we work continuously with our fund managers to increase their own impact over time. That only a small percentage of the portfolio scores this highly is not reflective of the impact intensity of the portfolio, but instead reflects that the bullseye score framework is intentionally designed to set a high bar and force thinking about how to generate even greater impact.